Blog

Is Bookkeeping Hard?

Obtain certification from the American Institute of Professional Bookkeepers or the National Association of Certified Public Bookkeepers https://pl.wikipedia.org/wiki/Euro (NACPB) after meeting eligibility requirements. You can apply for bookkeeping and payroll certifications with NACPB.

Process

Paying your vendor invoices should also be done in a timely manner, to avoid any late fees. Investors want to know the financial performance of your business to be able to want to quantify the value of their investment. The balance sheet, income statement, and cash flow statement all present the value of your business. With a bookkeeping process in place, you can have financial information ready for tax time.

Bookkeeper

Other small companies do not need permanent staff because of their small financial requirements. depreciation formula If you like working with numbers, consider starting a bookkeeping and payroll company.

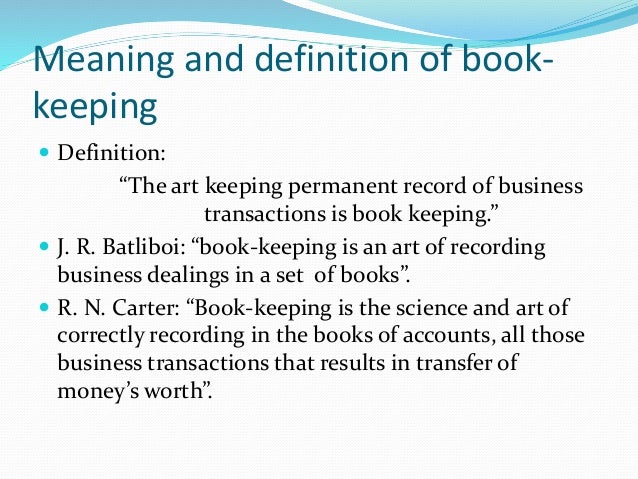

The main objective of book-keeping is to keep a complete and accurate record of all the financial transactions in a systematic orderly, logical manner. This ensures that the financial effects of these transactions are reflected in the books of accounts. https://www.bing.com/search?q=retained+earnings+equation&qs=n&form=QBLH&sp=-1&pq=retained+earnings+equation&sc=8-26&sk=&cvid=4EEF43B458E14D41A5355AB270333EAD The most common ones are the double-entry system and the single-entry system. But even methods other than these, which involves the process of recording financial transactions in any manner are acceptable book-keeping systems or processes.

Through book-keeping, detailed information about each expense or income could be obtained instantaneously. Then the second main objective is to ascertain the overall effect of all recorded http://ssbexams.com/are-your-donated-noncash-assets-recorded-correctly/ transactions on the final statement of the company. Book-keeping will eventually ascertain the final accounts of the company, namely the Profit and Loss Account and the Balance Sheet.

Should I Become a Certified Bookkeeper?

Accountants should always exercise sound moral judgment in all accounting activities. Also, the maintenance of books of accounts and financial statements is a legal requirement in many cases. In the case of companies or banks or insurance companies, there are acts that require such firms to keep and maintain financial records. One of the main reasons for bookkeeping is so records can be maintained to show the financial position of each and every head/account of income and expenditure.

You must pass an examination covering bookkeeping concepts before receiving certification. Accurate bookkeeping and payroll services are important to https://forexhero.info/ the successful operation of a company. Some companies cannot afford to hire staff permanently, so they employ the services of freelance bookkeepers.

You will save time that you would have spent trying to catch up at the end of the month if you update your financial records daily. If your books are always in order, you will have more time to focus on running your business. If you own a small business, keeping up-to-date financial https://www.youtube.com/results?search_query=торговые+платформы records is essential for your success. The routine recording of revenues, expenses, liabilities, and receivables, will allow you to track when your customer and vendor invoices are paid. As a business, you want to ensure that your customer invoices are being paid in a timely manner.

How much do bookkeepers make hourly?

(c) Attributes of TAP – Truthfulness, Openness, Fairness, Impartiality, Due process, Respect for the rule of law, etc.

Instead of scrambling for receipts or invoices, all of your financial information is organized on one central system. In fact, “poor accounting” is one of the top reasons businesses fail.

Without bookkeeping or accounting, you are blindly driving your business. Send your resume to employers looking for part-time bookkeepers. Inform employers of the benefits of hiring a freelance bookkeeping and payroll service provider as opposed to an employee. As an independent contractor, clients do not provide you with health benefits and other fringe benefits or pay payroll taxes. Promote these cost-saving facts when you speak with them about the benefits of hiring a freelance bookkeeping and payroll service provider.

What are the basics of bookkeeping?

Time. Given a lot of free time, many (not all) business owners are more than capable of doing their own bookkeeping. Trying to divide your time between higher level tasks and bookkeeping can create a stressful situation.

Posteado en: Bookkeeping